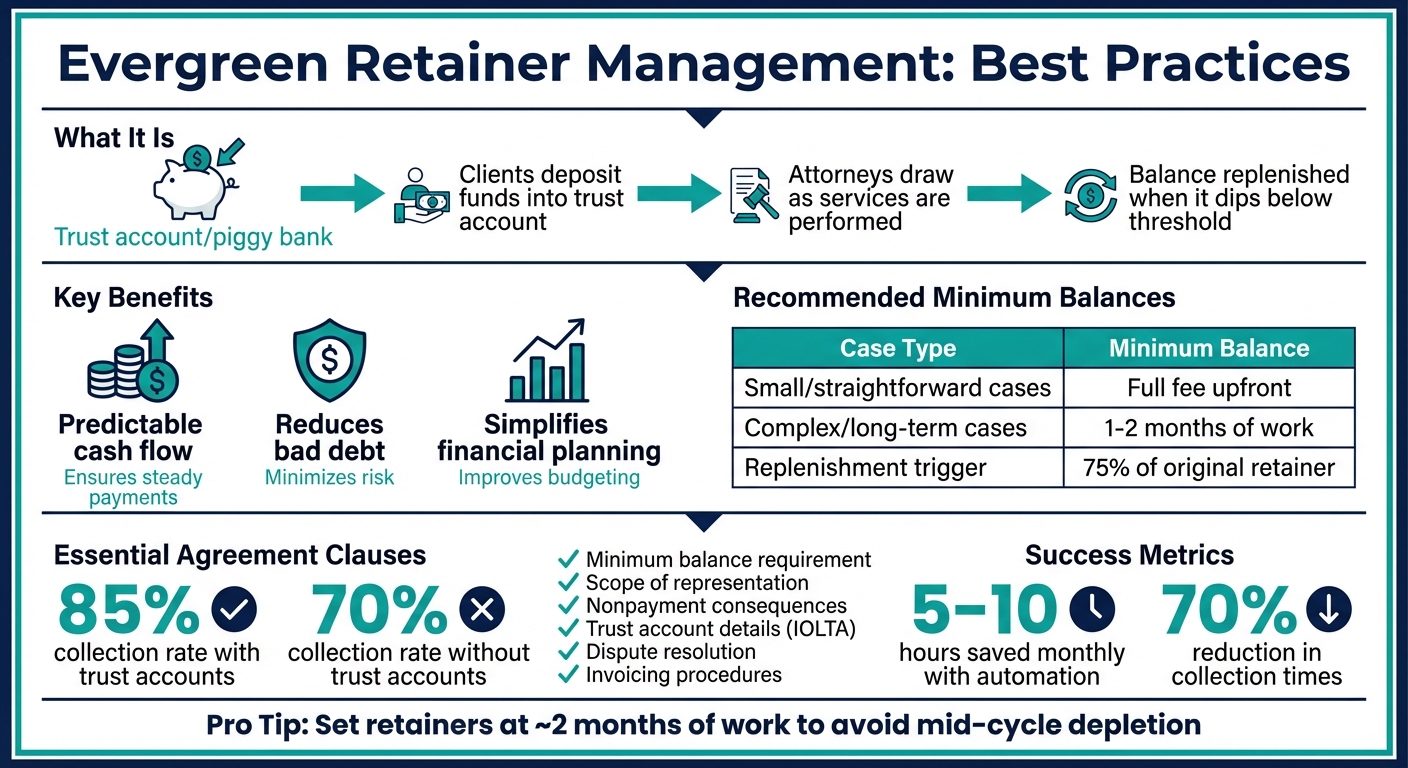

Evergreen retainers are a practical way for law firms to ensure steady cash flow and minimize unpaid fees. This billing model requires clients to maintain a minimum balance in a trust account, which they replenish as funds are used. Here’s why it’s effective and how to manage it:

- What It Is: Clients deposit funds into a trust account, and attorneys draw from it as services are performed. When the balance dips below a set threshold, clients must top it up.

- Why It Works: Ensures predictable payments, reduces bad debt, and simplifies financial planning for clients.

- Key Practices:

- Set realistic minimum balances (e.g., enough for two months of work).

- Clearly define replenishment policies in fee agreements.

- Use automated tools to track balances and send replenishment reminders.

- Ensure compliance with trust account rules, such as only transferring earned fees.

Evergreen retainers benefit both attorneys and clients by providing financial clarity and stability. With clear policies and the right tools, they can significantly streamline legal billing.

Evergreen Retainer Management Best Practices Guide

Setting and Managing Minimum Retainer Balances

To ensure steady cash flow while keeping things manageable for clients, it’s important to set a realistic minimum retainer balance. A common guideline is to maintain enough to cover roughly two months of services. Attorney Michael D. Poulos puts it simply: "I try to set the initial retainer at about two months work".

Of course, the specifics depend on the case. For smaller, simpler matters, you might collect the entire fee upfront. But for bigger cases – like complex litigation, divorces, or probate – it’s better to set a balance that’s a reasonable portion of the total estimated cost. This approach helps clients financially while ensuring your firm’s cash flow stays intact.

How to Calculate the Minimum Balance

Start by estimating the monthly workload for the case. Then, double that amount to account for two months of work. Adjust the number based on billing cycles, potential expenses, and the scope of work. The goal is to avoid a situation where the account runs dry mid-cycle, forcing you to ask for both a payment and a replenishment at the same time – something clients might perceive as double billing.

For returning clients, reviewing their payment history can help you set realistic replenishment amounts. Many firms use a trigger point for replenishment, such as when the balance drops to 75% of the original retainer.

| Case Type | Recommended Minimum Balance |

|---|---|

| Small, straightforward cases | Entire fee collected upfront |

| Complex or long-term cases | 1–2 months of work |

| Replenishment trigger point | When the balance hits the minimum or 75% used |

Creating Clear Replenishment Policies

Your fee agreement should spell out the details. This includes the minimum threshold (e.g., $1,000), the replenishment amount (e.g., $1,500), and the payment deadline.

"Client agrees to an advance retainer deposit of $2,500 paid with the execution of this agreement and further agrees to replenish the retainer with a $1,500 payment when the retainer balance reaches or is less than $1,000."

Make it easy for clients to pay by specifying accepted methods like credit cards, ACH, or eChecks, and include custom payment links to simplify the process. Some firms even round replenishment amounts to the nearest $100 to keep accounting simple. Be upfront about the consequences of not replenishing on time – such as pausing or stopping work until the balance is restored.

Explaining Balance Policies to Clients

Once your policies are set, communicate them clearly to clients. The intake process is a great time to explain how evergreen retainers work. Let clients know their funds remain theirs, held in a trust account, until services are performed and invoiced. This transparency builds trust and encourages cooperation.

"Think of it like keeping gas in your car’s tank. As we progress with your case and draw on funds, we replenish the balance so you never run out".

Reassure clients that every invoice will clearly show the starting balance, the amount applied to services, and the remaining balance. This way, replenishment requests won’t come as a surprise.

Use legal practice management software to monitor retainer accounts automatically. This is especially helpful when using legal software for paralegals to streamline administrative tasks. Tools like "Low Retainer Reminders" can alert you when balances approach the minimum threshold. As CosmoLex advises, "As soon as the fund has fallen below some pre-determined amount… request additional funds right away. That gives the client time to send you payment… without affecting your practice’s cash flow".

Tracking and Replenishing Retainer Balances

Once replenishment policies are in place, keeping a close eye on retainer balances is crucial to ensure funds are always available. Manual tracking can be tedious and prone to mistakes, which is why automated systems are a game-changer for managing evergreen retainers efficiently.

Automating Balance Tracking

Using billing software that syncs with trust account management systems provides real-time updates on fee transfers between trust and operating accounts. By setting a "Minimum Retainer Balance Required" at the matter level, the system can automatically flag accounts when funds drop below the threshold.

Automation tools can also handle replenishment requests, sending alerts via email or SMS as soon as a balance hits the minimum. This eliminates the need for constant manual reviews and ensures notifications reach the right team members – whether that’s legal assistants or the accounting department. Clear invoicing is another essential piece. Sending detailed monthly invoices that show the starting balance, applied fees, and remaining funds helps clients stay informed and prepared to top up their accounts when needed. Here’s how automation tools can fit seamlessly into your workflow.

Making Payments Easy for Clients

Simplifying the payment process for clients means quicker replenishments. Adding custom payment links to replenishment reminders allows clients to instantly fund their trust accounts using credit cards, debit cards, or eChecks.

For even greater efficiency, batch reminders let firms send all outstanding requests with just one click. This feature can save firms between 5–10 hours each month on billing tasks and reduce collection times by as much as 70%.

Following Trust Account Rules

When it comes to managing retainer funds, compliance is non-negotiable. Retainer funds must be stored in a dedicated trust account, such as an IOLTA, because they remain the client’s property until earned. Funds can only be transferred to an operating account after an invoice for earned fees has been issued.

"Any unearned portion of an evergreen retainer held in a trust account must be refunded to the client at the conclusion of the matter, according to trust accounting rules." – LawPay

To ensure accuracy and compliance, conduct three-way reconciliations between your trust bank account, trust ledger, and individual client ledgers. Billing software with integrated trust account management can help prevent overdrafts and ensure unearned funds are preserved until they’re earned. Always use invoices – not sales receipts – for trust retainer payments to maintain a proper audit trail for bar compliance.

Writing Evergreen Retainer Agreements

When it comes to managing retainer balances and replenishment policies, a well-constructed evergreen retainer agreement is key. This type of agreement not only establishes clear expectations for fees and services but also ensures smooth financial processes. As the American Bar Association puts it, "The best indicator of what the client understood is the retention agreement".

Introducing the evergreen retainer structure early – during client intake – sets the tone for transparency and ensures clients are aware of their financial commitments from the start. Using legal practice software and templates that align with your jurisdiction’s rules is especially important. Generic templates, while convenient, can lead to compliance issues with local bar association ethics standards.

Required Clauses for Retainer Agreements

To function effectively and meet ethical standards, evergreen retainer agreements need to include certain critical clauses. These clauses set the foundation for smooth operations and minimize misunderstandings.

- Minimum Balance Requirement: Define a clear trigger for replenishment. For example, specify a threshold amount that, once reached, requires the client to make a payment. This eliminates ambiguity and ensures timely replenishment.

- Scope of Representation: Clearly outline the legal services covered under the agreement. This prevents clients from assuming unrelated services are included.

- Nonpayment Consequences: State that work may be paused if the client does not meet replenishment requirements. This clause protects the firm while setting clear expectations for clients.

- Trust Account Details: Explain that funds will be held in a separate trust account, such as an IOLTA, and will remain the client’s property until earned and invoiced.

- Dispute Resolution: Include a clause that specifies how disputes will be handled – typically through arbitration or mediation.

- Invoicing Procedures: Differentiate between invoices for services rendered and requests for trust replenishment to avoid confusion.

Here’s a quick reference table for key clause categories and their essential details:

| Clause Category | Essential Details to Include |

|---|---|

| Financial Triggers | Minimum balance threshold; replenishment amount; payment deadlines. |

| Operational Terms | Accepted payment methods (e.g., credit card, eCheck); interest on late payments. |

| Trust Compliance | Statement that funds are held in IOLTA; notice that unearned funds are refundable. |

| Work Stoppage | Timeline for pausing work; conditions for restarting services. |

| Communication | Frequency of invoices; how balance reconciliations are displayed. |

While these clauses are essential, drafting them with precision is equally important to avoid confusion or disputes.

Common Agreement Mistakes to Avoid

Some retainer agreements fall short due to vague or poorly defined terms. For instance, unclear replenishment triggers – such as not specifying an exact minimum balance or payment timeframe – can lead to delays in collections. Similarly, an ambiguous scope of work can leave clients guessing about what services are included.

Another common issue is the perception of double billing. If the retainer amount is set too low and depletes mid-month, the firm might need to request both a replenishment and additional payment for overages. As Catherine Brock from LawPay explains, "To clients, [mid-month overruns] can appear to be double billing. That’s likely to prompt questions and, possibly, introduce doubt about the legitimacy of your billing process". Setting the initial retainer and replenishment amounts high enough can help avoid this scenario.

Additionally, always disclose staff billing rates upfront to reduce the risk of fee disputes. Finally, specify when representation ends to prevent confusion about post-judgment responsibilities. Once the agreement is finalized, standardizing it across the firm ensures consistency in handling replenishment requests and client expectations.

sbb-itb-95f4849

Using The Legal Assistant for Retainer Management

Managing retainers manually can eat up a lot of time and lead to unnecessary mistakes. To address the challenges of manual tracking and outdated billing methods, The Legal Assistant offers a set of tools designed to simplify these processes. By combining automation, integrated billing, and enhanced client communication, this software helps reduce errors and improves collection rates.

Automation Tools for Retainer Management

The Legal Assistant takes automated balance tracking to the next level. Law firms can set a minimum retainer balance for each matter, and the software keeps an eye on trust account balances in real time. If the balance dips below the set threshold, it triggers an alert. Firms can also send out batch replenishment requests with just one click, making it easier for clients to top up their funds without delay.

Billing and Trust Account Compliance Features

With The Legal Assistant, trust account management is seamlessly integrated into the billing system. This ensures that fees are only transferred from the trust account to the operating account once they’ve been earned and invoiced – keeping everything compliant with strict trust account rules. Minimum balance thresholds help ensure firms don’t work on cases without secured funds, as accounts are automatically flagged when they fall below the required level. Detailed invoices provide clients with a clear breakdown of their retainer balances and any new charges. According to the 2017 Legal Trends Report, matters linked to trust accounts had an 85% collection rate, compared to just 70% for those without such safeguards.

Client Communication Tools

The Legal Assistant makes it easy for firms to reach out to clients with replenishment requests via email and SMS. These messages include direct links for online payments, whether through credit card or eCheck, allowing clients to quickly refill their retainers. Firms can also customize email and SMS templates to maintain a consistent and professional tone. By clearly separating service invoices from trust replenishment requests, the software helps prevent client confusion and payment delays. Plus, regularly updating these templates ensures compliance with local bar association guidelines. These communication tools play a big role in boosting the efficiency of retainer management.

Conclusion

Effective evergreen retainer management is a game-changer for building a stable practice with reliable cash flow and happy clients. By setting clear minimum balances, automating tracking, and maintaining open communication, you can avoid the hassle of chasing payments and the disruptions caused by insufficient client funds. Firms using trust accounts see an 85% collection rate, compared to just 70% for those without them.

This approach benefits both your firm and your clients. Breaking hefty legal costs into smaller, more manageable replenishment amounts makes your services easier to afford. For instance, a $4,000 minimum balance is much more attainable for most clients than a $20,000 upfront retainer. Clear invoicing and regular updates ensure clients understand how their funds are being used, fostering trust and reducing misunderstandings.

"Having an evergreen retainer in place ensures your client will always have enough funds to make a payment. With funds available in trust, you don’t have to wait to get paid." – Teresa Matich, Clio

The right tools can simplify this process significantly. The Legal Assistant offers automated balance monitoring, one-click replenishment requests, and trust account compliance features to reduce manual errors and free up your staff’s time. Clear payment requests and direct links keep cases on track and uninterrupted.

FAQs

What are the advantages of using evergreen retainers for law firms and their clients?

Evergreen retainers offer a win-win arrangement for law firms and their clients by addressing financial and administrative concerns on both sides.

For law firms, these retainers provide a steady cash flow. By requiring clients to replenish their retainer funds whenever the balance falls below a certain threshold, firms can minimize unpaid invoices and simplify their financial management. This system significantly boosts collection rates, often ensuring payments are made on time. Plus, billing becomes more efficient since invoices are automatically settled from the trust account, cutting down on administrative work.

From the client’s perspective, evergreen retainers bring convenience and predictability. Instead of dealing with frequent bills and multiple payments, clients only need to top up the retainer as needed. This reduces administrative burdens and eliminates unexpected costs. The clarity of this system also builds trust, making the client-lawyer relationship stronger while keeping legal expenses easier to manage.

What key elements should be included in an evergreen retainer agreement?

An evergreen retainer agreement needs to clearly spell out the client’s obligation to maintain a minimum balance in the trust account at all times. It should also explain how this balance will be monitored and detail the steps for requesting additional funds if the balance drops below the required level.

For clarity and transparency, include specifics about how the funds will be used for services and any deadlines for replenishing the account. This approach minimizes confusion and ensures the agreement remains straightforward and workable for both parties.

How does automation make managing evergreen retainers easier?

Automation takes the hassle out of managing evergreen retainers by taking care of repetitive tasks, cutting down on mistakes, and saving valuable time. For instance, automated tools can handle tasks like generating invoices, keeping tabs on retainer balances, and topping up trust accounts when funds dip below a certain limit. This keeps cash flow steady and reduces the need for constant manual oversight.

On top of that, automation can send clients timely alerts when their retainer balances are running low. This kind of proactive communication helps ensure accounts stay funded, avoids compliance headaches, and keeps everything running smoothly. By simplifying these processes, law firms can shift their focus back to what they do best – providing top-notch legal services – without getting bogged down in retainer management.