Managing client trust accounts is a critical responsibility for attorneys. Mishandling funds – even accidentally – can lead to severe consequences, including license suspension or disbarment. Common issues like mixing client funds with operating accounts, poor record-keeping, and skipping reconciliations are avoidable with proper systems. Here’s what you need to know:

- Keep funds separate: Always use dedicated trust accounts for client money. Mixing funds, even unintentionally, puts your practice at risk.

- Reconcile monthly: Match your bank statements, trust ledger, and client ledgers every month to catch errors early.

- Maintain accurate records: Track every transaction in real time and ensure each client has a separate ledger.

- Avoid overdrafts: Wait for funds to clear before disbursing and monitor balances closely.

Using legal practice management software can simplify these tasks, reduce errors, and help you stay compliant. Tools like The Legal Assistant automate reconciliations, ledger updates, and record backups, saving time and protecting your practice.

Trust Account Compliance Statistics and Common Violations

Mixing Client Funds with Operating Funds

Mixing client trust funds with operating funds is a serious breach of professional responsibility. To safeguard client assets, it’s essential to maintain separate accounts. The American Bar Association (ABA) Model Rules stress this point:

The basis for Rule 1.15 is the lawyer’s fiduciary obligation to safeguard trust property, to segregate it from the lawyer’s own property, and to avoid the appearance of impropriety.

Combining client funds with your operating funds puts client money at risk. It exposes those funds to potential claims from your firm’s creditors and opens the door to unintentional or unauthorized use. Importantly, clients cannot waive this obligation. Keeping these accounts separate ensures that client funds are protected from your business’s financial issues and are always available for immediate return if needed.

Why Mixing Funds Happens

Most cases of commingling aren’t intentional but result from simple mistakes. One common error is depositing retainers into the wrong account, especially when using payment processors not designed for legal trust accounting. Another frequent issue arises when attorneys fail to transfer earned fees from the trust account to the operating account after billing. Once you’ve earned and invoiced for your work, those funds belong to you and must be moved accordingly. As LawPay explains:

When the funds in a trust account go from client funds to your funds, they need to be removed from the account. Leaving personal funds in the trust can lead to problems.

Some attorneys also engage in "cushioning", where they intentionally leave extra firm money in the trust account. While seemingly harmless, this practice violates ethical rules and complicates proper fund management.

How to Prevent Mixing Funds

The key to avoiding commingling lies in maintaining clear boundaries between accounts. Use one operating account for your firm’s income and expenses, and a separate trust or IOLTA account solely for unearned client funds. The only firm money in the trust account should be a small amount to cover bank fees.

To further minimize errors, establish clear protocols for managing funds. For example:

- Promptly transfer earned fees to the operating account after billing.

- Assign different staff members to handle deposits and disbursements, with a lawyer overseeing the final reconciliation.

- Develop consistent procedures for all trust account activities.

Technology can also help. Legal practice management tools like The Legal Assistant (https://thelegalassistant.com) automate fund separation and track earned versus unearned fees in real time. With over 150,000 lawyers now using IOLTA-compliant payment solutions, the profession is moving toward automation to reduce errors and ensure compliance.

Skipping Monthly Three-Way Reconciliations

Skipping monthly three-way reconciliations can leave your practice vulnerable to serious compliance risks. This process involves matching three critical records: the bank statement, the trust ledger (your firm’s internal transaction record), and the total of all individual client ledgers. Precision is non-negotiable – even a single cent off could signal a problem.

Why Three-Way Reconciliation Matters

Neglecting monthly reconciliations lets small inconsistencies snowball into bigger issues over time. What could take minutes to correct now might demand hours of digging later. Worse, a lack of regular oversight opens the door to undetected fraud or theft.

The consequences can be severe, even if no money is actually missing. For example, Sacramento attorney James Benson faced a six-month suspension for failing to reconcile his IOLTA account. Similarly, a Florida lawyer received a two-year suspension for prolonged non-reconciliation. As Amy Coats of Accounting Atelier puts it:

They failed to maintain systems that proved they weren’t stealing money. That distinction doesn’t matter to bar regulators.

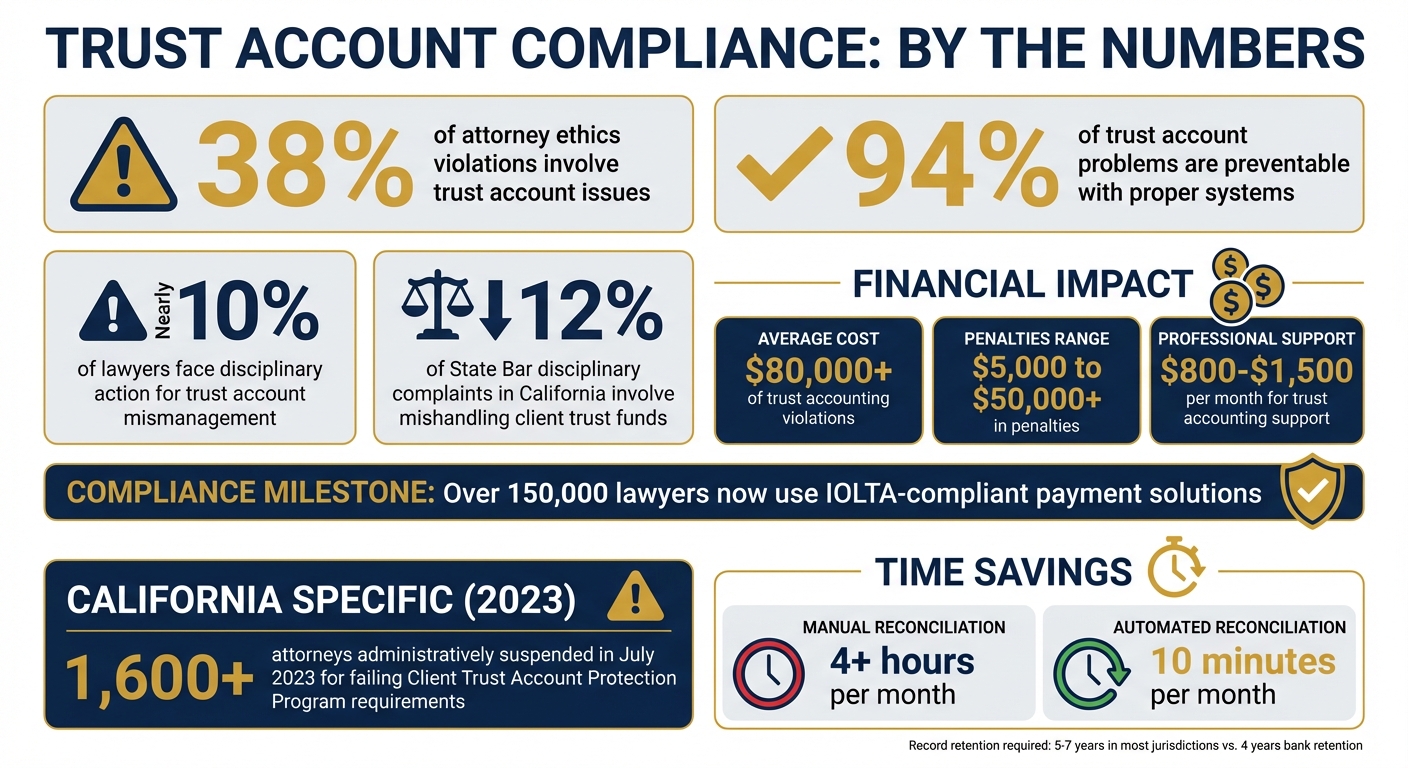

Many states, including Pennsylvania, New York, and California, require monthly reconciliations by law under programs like the Client Trust Account Protection Program. The stats are eye-opening: nearly 10% of lawyers face disciplinary action for trust account mismanagement, and 38% of attorney ethics violations involve trust account issues. Research shows that 94% of these problems are avoidable with proper systems in place.

Regular reconciliations, alongside practices like maintaining separate accounts, are essential for effective trust account management.

Making Reconciliation Easier

To stay on top of this, schedule your reconciliation within five business days of receiving your bank statement. Dedicate 60–90 minutes on your calendar specifically for this task.

Separate responsibilities among your staff to minimize errors. For instance, the person handling deposits shouldn’t also manage disbursements or perform the final reconciliation. This division of duties creates built-in checkpoints throughout the month.

Leverage modern legal practice management software to simplify the process. Tools like The Legal Assistant can automate the three-way matching process and keep an audit trail of transactions. With such software, monthly reconciliation time can drop from over four hours to just 10 minutes. These tools also flag discrepancies automatically and help avoid errors like negative client ledger balances.

This streamlined approach pairs well with strict fund segregation practices, ensuring your trust account management stays on solid ground.

Poor Record-Keeping and Client Ledger Management

Poor record-keeping can put compliance at serious risk. A common mistake many attorneys make is treating their trust account as a single pool of funds. Instead, it’s crucial to maintain a separate ledger for each client. This ensures you can track individual funds accurately and avoid overdrawing any account. Just like timely reconciliations, keeping detailed and accurate records is essential to steer clear of compliance issues.

Frequent Record-Keeping Errors

Some of the most frequent mistakes include leaving out important transaction details – like check numbers, dates, amounts, or purposes – and delaying updates to client ledgers. These oversights can distort running balances and make it nearly impossible to maintain accurate, real-time records of client accounts.

Whenever you make a trust account transfer, you need to update the client ledger to indicate what is remaining in the account and then update the client.

- LawPay

The consequences of poor record-keeping can be severe. For example, in In re Dias, 201 N.J. 8, the New Jersey Supreme Court addressed a case where an attorney’s sloppy record-keeping led to over-disbursement and negligent misappropriation of client funds. Another risk comes from failing to back up trust account records daily. Losing months of financial data due to a lack of backups can be devastating. To make matters worse, most state bars require that trust account records be preserved for five to six years after a case concludes.

How to Improve Record-Keeping

To avoid these pitfalls, make it a habit to record every deposit or disbursement in real time. Include key details like check or wire numbers, dates, amounts, purposes, and updated balances. Any time a check is signed or a withdrawal is approved, it should be logged immediately.

Moving away from manual spreadsheets can also make a big difference. Cloud-based legal practice management tools, like The Legal Assistant (https://thelegalassistant.com), simplify the process by automating real-time ledger updates, performing daily data backups, and maintaining audit trails. Features like built-in three-way reconciliation are particularly helpful for staying compliant.

It’s also wise to establish clear, written procedures for managing client funds. These should outline how and when clients are notified about receipts and disbursements. Attorneys Benjamin J. DiLorenzo and Kyle A. Valente emphasize the importance of vigilance in this area:

Trust account violations that could have otherwise been prevented with better recordkeeping practices are far too common. Let your trust account be a reflection of your integrity, not a liability to your license.

- Benjamin J. DiLorenzo and Kyle A. Valente

sbb-itb-95f4849

Trust Account Overdrafts and Improper Disbursements

Trust account overdrafts are among the most serious compliance issues an attorney can face. Even a minor overdraft – just one dollar – can lead to automatic reporting to the state bar, potentially triggering an audit of your firm’s financial records.

The consequences of mismanaging trust accounts are severe. In California, for example, mishandling client trust funds has historically been the basis for around 12% of all State Bar disciplinary complaints. In July 2023, more than 1,600 attorneys in California were administratively suspended for failing to meet the reporting and certification requirements of the Client Trust Account Protection Program. These attorneys could not practice law until they complied with the mandated regulations.

What Causes Trust Account Overdrafts

One common cause of overdrafts is disbursing funds before they have fully cleared the banking system. Attorney Sheila M. Blackford explains the distinction between "cleared funds" and "collected funds", emphasizing the importance of the latter for protecting client assets:

There is a difference between cleared funds and collected funds. When a bank says you have $200 cleared after depositing $200, you merely have $200 in your account. The funds need to be collected from the issuing bank otherwise that $200 belongs to another client.

- Sheila M. Blackford, Attorney, Oregon Wise

Banks may hold deposits of $5,000 or more for up to seven days, regardless of whether the check is local or out-of-state. Overdrafts can also occur if an attorney writes a check exceeding the balance in a specific client’s ledger, even if the overall trust account balance appears sufficient. A compliance expert from LeanLaw highlights this issue:

Spending even one dollar more than the available client funds is effectively using one client’s money for another purpose, and it triggers an automatic red flag.

- LeanLaw

These scenarios highlight the critical need for strict oversight and control.

How to Prevent Overdrafts and Errors

Preventing overdrafts starts with addressing their root causes. Allow sufficient time for funds to clear: at least three banking days for local checks, five days for in-state checks, and ten days for out-of-state checks. To avoid bank fees affecting client funds, maintain a small fee cushion in the trust account.

Implementing low-balance alerts can help you monitor account activity and avoid accidental overdrafts. Additionally, disabling ATM and debit card access and requiring dual authorization for trust account transactions adds an extra layer of protection against errors and unauthorized withdrawals.

Daily monitoring of trust account transactions is another essential practice. Verifying each client’s sub-account balance before making disbursements can help catch discrepancies or unauthorized activity early. Legal practice management software offers a practical solution by automating checks to ensure disbursements do not exceed individual client balances.

It’s important to remember that trust account compliance is ultimately the attorney’s responsibility. Even if a bookkeeper or office manager handles the ledgers, the attorney remains fully accountable for any errors or misconduct. Taking proactive steps to validate funds and maintain accurate records is crucial for protecting both your clients and your practice.

Using Technology to Maintain Compliance

Problems with Manual Processes

Managing trust accounts manually comes with serious compliance risks. Whether you’re recording transactions by hand or juggling disconnected spreadsheets, transposition errors are almost unavoidable. Imagine entering $1,324 instead of $1,234 – this small mistake can lead to major problems, including bar complaints.

Here’s the reality: 38% of attorney ethics violations stem from trust account mismanagement, yet 94% of these violations are preventable with the right systems. The financial consequences are steep. On average, trust accounting violations cost firms over $80,000 when you factor in penalties (ranging from $5,000 to $50,000+), remediation efforts, and lost productivity.

Manual processes also eat up time. Monthly reconciliations often get delayed, making it easier for small errors to snowball. As attorney Sheila M. Blackford explains:

The practice of law is time-consuming but never more than the time required managing your firm’s finances by hand.

When reconciliations fall behind, a minor $5 discrepancy can turn into a $5,000 issue that only surfaces during an audit.

Disconnected systems – like spreadsheets that don’t sync with bank statements or accounting software – add another layer of complexity. Without real-time tracking, discrepancies such as bank fees, IOLTA interest adjustments, or timing gaps are left unresolved. On top of that, inconsistent processes for transferring earned fees from trust to operating accounts increase the risk of accidental commingling.

These challenges highlight why a digital solution is essential.

How Legal Practice Management Software Helps

Legal practice management software offers a way out of these challenges by automating processes and reinforcing compliance.

Take The Legal Assistant, for example. This software simplifies trust account management with its billing management and intelligent automation features. Its cloud-based system creates separate digital ledgers for each client matter, tracking deposits, disbursements, and fee transfers in real time. This eliminates the manual entry errors that are so common with spreadsheets.

The billing management feature ensures funds are only moved from trust to operating accounts after invoices are generated, creating a clear audit trail that confirms fees were earned before being transferred. Meanwhile, intelligent automation flags potential issues – like trying to disburse more than a client’s available balance – before they escalate into compliance violations. By automating ledger updates and reconciliations, the software directly addresses the common errors of manual systems.

Cloud hosting adds another layer of security with automatic daily backups. This is particularly important because most banks only keep transaction records for four years, while many jurisdictions require firms to retain records for five to seven years . With cloud storage, your trust account records are safe, even if your physical office faces a disaster.

The software’s document generation and task management tools also support compliance by standardizing workflows for monthly reconciliations. You can set recurring tasks to ensure reconciliations are completed within 10 days of receiving bank statements, and generate audit-ready reports documenting your three-way reconciliation process. At $49 per user per month (with annual billing) or $55 per month (on a monthly plan), this software is a fraction of the cost of professional trust accounting support, which typically ranges from $800 to $1,500 per month.

Conclusion

From our earlier discussion of common trust account errors, one thing stands out: compliance isn’t just a legal requirement – it’s a responsibility that safeguards both your clients and your professional license. According to ABA Model Rule 1.15, maintaining a strict separation of client funds is non-negotiable. Failing to do so can lead to state bar discipline (like suspension or disbarment), civil liability for mismanaging client funds, and long-term damage to your reputation.

Fortunately, these errors are avoidable. The solution lies in moving away from manual processes prone to mistakes and embracing tools that ensure compliance with ease. That’s where digital tools become a game-changer for today’s law firms.

Take The Legal Assistant, for example. This software automates key tasks like fee verification, ledger maintenance, and daily backups. By using cloud-based client ledgers and automated reconciliation, it helps law practices stay compliant while reducing the risk of human error. Plus, its daily backups secure financial records well beyond the typical four-year bank record retention period.

At just $49 per user per month (billed annually), investing in a reliable trust account management system not only prevents costly compliance issues but also reinforces the trust your clients place in you – and protects the license that makes your practice possible.

FAQs

What are some common trust account mistakes attorneys should avoid?

Attorneys often stumble into trouble when managing trust accounts due to a few key missteps. These include misappropriating funds, failing to keep accurate and current ledgers, mixing client funds with personal or business accounts, and overdrawing the trust account. Other frequent problems involve delays in disbursing funds and not keeping clients informed about account activity.

To steer clear of these issues, it’s crucial to have clear processes in place for tracking all transactions, reconcile accounts on a regular basis, and maintain a strict separation between client funds and other accounts. Tools like legal practice management software can be a game-changer, helping attorneys stay compliant while simplifying trust account management.

How does legal practice management software help ensure trust account compliance?

Legal practice management software plays a crucial role in maintaining trust account compliance by automating critical tasks such as recordkeeping and tracking client funds. It ensures that funds are properly segregated, enables accurate and timely disbursements, and provides detailed reports to meet compliance standards.

By minimizing manual errors and simplifying trust account management, this software helps law firms steer clear of common pitfalls that could result in financial mismanagement or disciplinary issues. It’s an indispensable resource for ensuring precision and safeguarding client trust.

Why is it important to perform a monthly three-way reconciliation for trust accounts?

Performing a monthly three-way reconciliation is a must for keeping your trust account in check. It’s all about making sure three key balances align: your client ledger, trust account checkbook, and bank statement. When these match, you can quickly catch any discrepancies, fix errors, and protect against any misuse of client funds.

Beyond just balancing the numbers, this regular checkup shows you’re on top of things. It proves you’re exercising due diligence, which helps reduce the chances of facing disciplinary issues. Plus, it builds confidence with your clients – they’ll see that you’re managing their funds responsibly. Making this a routine part of your process is a solid way to stay on track with both ethical and legal obligations at your firm.