What is the HUD-1 Settlement Statement?

HUD is an acronym for Housing and Urban Development, and represents the arm of the U.S. government department responsible for legislation relating to home ownership and property development within the United States of America.

HUD is an acronym for Housing and Urban Development, and represents the arm of the U.S. government department responsible for legislation relating to home ownership and property development within the United States of America.

The HUD-1 form, often also referred to as a “Settlement Statement”, a “Closing Statement”, “Settlement Sheet”, combination of the terms or even just “HUD” is a document used when a borrower is lent funds to purchase real estate.

Another acronym used in relation to the HUD form is GFE, which means ‘Good Faith Estimate’. The ‘Good Faith Estimate’ was incorporated into the HUD form in 2010 and presents figures initially estimated by the lender in order to compare with the final HUD figures.

When is a HUD-1 Settlement Statement used?

Another term linked with the HUD is RESPA. RESPA is an acronym for Real Estate Settlement Procedures Act and represents a set of legislative statutes relating to real estate transactions put in place by the government to enforce disclosure of charges and fees to the consumer.

According to the RESPA act, the HUD form is to be used by all lenders of loans providing funds for real estate purchases and refinances of real estate loans and must be given to the borrow at least one day prior to the date of settlement.

A settlement agent, or closing agent, will prepare a HUD-1 settlement statement at the closing of a real estate loan. The final version will explicitly state all costs involved with the real estate loan and to whom the individual charges and fees will be paid to. This provides the borrow and the seller with a concise breakdown of all costs involved. Good Faith Estimate figures will typically be sent from the lender to the settlement agent within three days of application of the loan.

The settlement agent can take the form of a title agency, mortgage broker, even the bank could act as a settlement agent however it is recommended hiring an experienced real estate law firm experienced in real estate closings to take care of the closing.

What information is provided on a HUD-1 Settlement Statement?

Aside from the basic details of the involved parties, consisting of the buyer and seller, the lender, property details and settlement agent details, unsurprisingly the majority of the settlement statement consists of figures. Lots of figures.

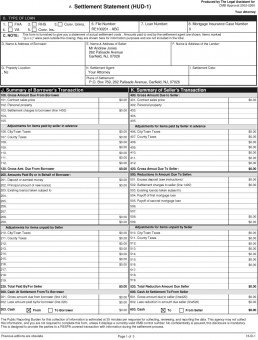

Page One

The first page lists figures in a dual column format listing buyer details on the left and where applicable, the seller details on the right. Details you will find on page one include;

- The gross amount due from the buyer and to the seller.This includes the contract sales price, value of any personal property and the total amount of the settlement charges and fees extracted from the final total on page 2 (line 1400).

- Adjustments for items paid in advance by the seller primarily calculated from taxes paid.

- Amounts paid for by or in behalf of the borrow, and reductions in the amount due to the seller.

- Adjustments for items unpaid by the seller

- Cash at settlement due from or to the buyer and seller

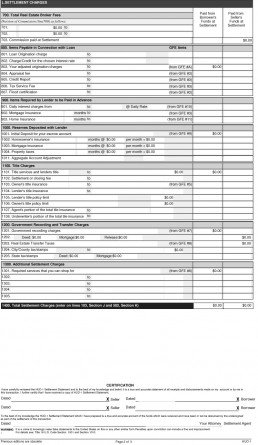

Page Two

Page two details the associated fees and charges involved with the settlement, although the various figures and details are listed down the page, there again features two columns representing the charges paid by buyer and the charges paid by the seller.

- Broker fees

- Fees related to the loan

- Items required to be paid in advance by the lender

- Deposits reserved with the lender

- Title charges

- Government recording and transfer charges

- Any additional settlement charges

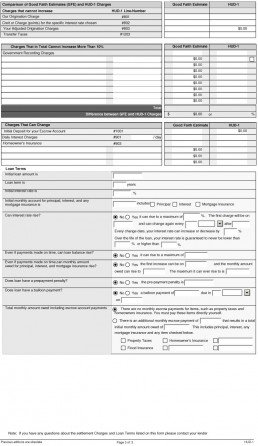

Page 3

Page three features figures relating to the Good Faith Estimate (GFE) and the details of the loan terms. The GFE estimate figures will have been supplied to the settlement agent by the bank upon application of the loan, the HUD figures will be listed side by side by the GFE figures in order to easily spot any discrepancies or wide variations in amounts. The loan terms include the originating loan amount, interest rate, interest rate details, and other payment details.

Are there problems with the HUD-1 Settlement Statement?

Despite best efforts by the Housing and Urban Development department and the RESPA, mistakes can and do happen when preparing the settlement statements. It is extremely important to understand each and every entry on the HUD form. As previously mentioned it is highly recommended hiring an experienced real estate attorney to take care of the closing as in addition to resolving any legal disputes, they are likely to make use of specialist real estate closing software which will reduce the chances of human error when preparing the settlement statement by means of validating input, ensuring figures are within allowed ranges and automatically calculating figures used throughout the HUD form.

HUD-1 RESPA & GFE FAQs

Below is a set of very frequently asked questions as presented to real estate attorneys when acting as closing agents.

What are the bank charges/escrows?

Bank Charges are fees paid to the bank for processing the loan. These fees are typically an origination fee or a processing fee which may be a fixed rate or based upon a % of the loan, (ie 1%) range from Credit reports, or fees that the bank expends while trying to get the loan approved. Examples are Appraisal fees, credit report fees, flood certification fees, etc.Bank Escrows are different from fees. Bank escrows are money that the bank wants on reserves that will be used to pay your upcoming bills for the home. These escrows are usually for property taxes, school taxes, county taxes and home owners insurance. They can range from one month to 4 months depending upon the date of the closing.

What is title insurance?

A title insurance policy is a mandatory insurance policy taken out when you are taking out a mortgage. The philosophy behind it is that there are issues that can arise relating to the title ownership of the land. Be it, problems with the past deeds, i.e. missing signatures or invalid information or more extreme issues like the detection of fraud relating to the title ownership of land. The title insurance is there to protect you up to the value of the policy when something does go wrong. And bear in mind, since humans are involved – things do go wrong.

What are and why do I have to pay ‘reporting fee’s?

When will be my first mortgage payment?

Depending upon when you close, your payment is usually the second month after the closing date. An example is if the closing is September 15, the first mortgage payment will not be until November 1. The November 1st payment will represent the principal and interest for October. The interest from Sept 15-Sept 30 will be prepaid on the closing date.

Where is my closing credit?

A closing credit may be as a result of a bank providing a refund or a credit of some fees, or it could be a credit being given from the Seller to the Buyer for an open item. Usually this credit will be given on the first page of the respa, buyers side, indicating that the amount being credited is being added to the amount the Buyer has to use, therefore, a check will not be given to the Buyer at the time of the closing.

Why are the values between the GFE and final HUD figures different?

Many times the GFE and the final HUD figures do indeed differ from each other. The GFE figures are presented by a lender within 3 days of applying for ta loan. In many instances, these figures may increase or decrease. Many of these GFE disclosures cannot exceed a 10% tolerance given by the bank. Unless they are figures that can be shopped for, any tolerance of over 10% must be reduced by the Lender to adhere to the 10% tolerance level.

In every case any questions you may have on any element on the HUD form should be asked preferably to an attorney, and not disregarded. We recommend the services of Sammarro & Zalarick, P.A. a law firm with experience in all real estate matters.

Are you an attorney or paralegal working in real estate law? If the answer is Yes, then you must take a look at The Real Estate Assistant. The Real Estate Assistant, or T.R.E.A helps you handle the closing process from intake through to closing, boosting your productivity, lowering your overheads, and letting your firm scale.

Thanks for clear Picture about Hud settlement statement and its usage

Very thourgh explanation

This is great! Makes it easy to show to my clients!

~ April Bella, Realtor